Introduction

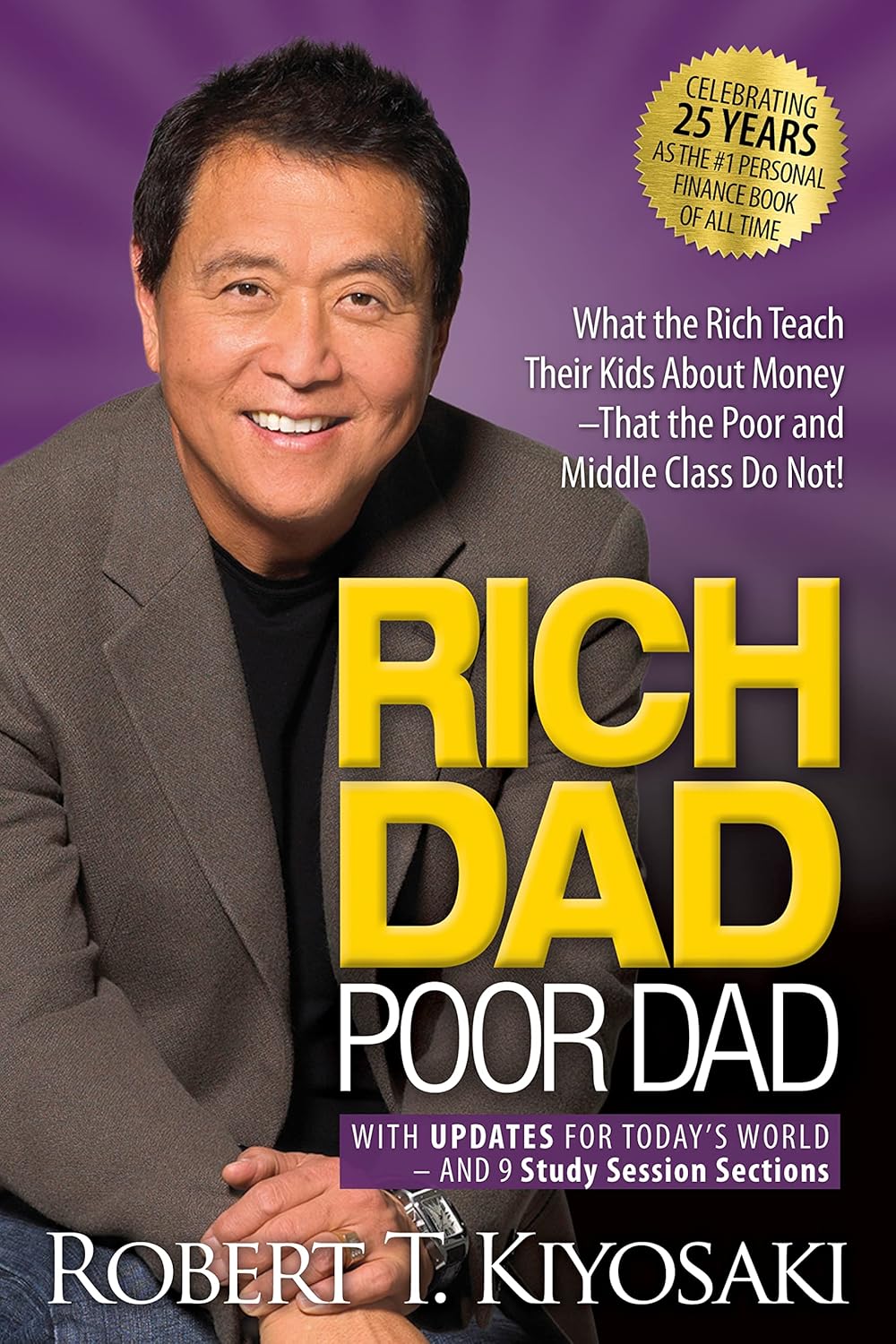

For many, achieving financial freedom and security seems like an elusive goal. Traditional education systems focus on academic success, but often fail to teach the essential skills needed to manage money effectively. “Rich Dad Poor Dad” by Robert Kiyosaki addresses this gap, offering invaluable lessons on money management, investing, and financial independence.

First published in 1997, “Rich Dad Poor Dad” has since become one of the most influential personal finance books of all time. Through the contrasting stories of two father figures, Kiyosaki provides a new perspective on wealth-building that challenges conventional financial wisdom.

In this blog post, we’ll explore the key concepts from “Rich Dad Poor Dad” and discuss how you can apply them to transform your financial life.

What is “Rich Dad Poor Dad” About?

“Rich Dad Poor Dad” revolves around the lessons Robert Kiyosaki learned from his two “dads”—his biological father (whom he calls “Poor Dad”) and his best friend’s father (whom he calls “Rich Dad”). These two men had very different approaches to money, and through their contrasting mindsets, Kiyosaki presents the fundamental differences between the wealthy and the middle class.

While Poor Dad followed the traditional path of academic success, a steady job, and saving money, Rich Dad took an entrepreneurial approach, focused on acquiring assets, and made money work for him. This book delves into the importance of financial literacy, mindset, and investment strategies that can lead to wealth accumulation.

Key Concepts in Rich Dad Poor Dad

- The Importance of Financial Education:

- One of the main ideas in “Rich Dad Poor Dad” is the need for financial literacy. Kiyosaki argues that schools don’t teach students how to manage money, invest, or build wealth. Instead, they focus on subjects that prepare you for a job rather than financial freedom.

- Kiyosaki stresses the importance of learning about financial concepts such as assets, liabilities, cash flow, and investing. The more financial knowledge you have, the better equipped you’ll be to make informed decisions about your money.

- Assets vs. Liabilities:

- Kiyosaki emphasizes the concept of assets and liabilities. He defines assets as things that put money in your pocket, such as rental properties, stocks, and businesses. Liabilities, on the other hand, take money out of your pocket, such as loans, credit card debt, and mortgages.

- According to Kiyosaki, the wealthy focus on acquiring assets, while the middle class and poor often accumulate liabilities that hinder their wealth-building efforts. He encourages readers to invest in income-generating assets that provide cash flow.

- The Rat Race:

- Kiyosaki describes the rat race as the cycle of working for a paycheck, paying bills, and repeating the process. Many people work hard, but their expenses always seem to grow, preventing them from achieving financial freedom.

- Instead of relying solely on earned income (a salary), Kiyosaki advocates for building passive income streams through investments, businesses, and assets that can generate money while you sleep.

- The Power of Entrepreneurship:

- Rich Dad taught Kiyosaki the value of entrepreneurship and the importance of owning businesses. According to Kiyosaki, starting a business is one of the best ways to build wealth because it allows you to create multiple streams of income, which can eventually lead to financial independence.

- Entrepreneurship also provides the freedom to take risks and create value in the marketplace. Kiyosaki argues that becoming an entrepreneur is a key step toward escaping the rat race and achieving financial freedom.

- The Importance of Sales and Marketing Skills:

- Kiyosaki stresses the importance of learning how to sell and market. Whether you’re selling a product, an idea, or even yourself, sales and marketing skills are crucial for success in any venture.

- Being able to effectively communicate, persuade, and market is essential for entrepreneurs and investors. Kiyosaki believes that mastering these skills can help you build wealth and create financial opportunities.

- Working for Money vs. Making Money Work for You:

- Rich Dad taught Kiyosaki to think differently about money. Instead of working hard for money, Kiyosaki argues that we should learn how to make money work for us. This involves understanding how to invest in assets that generate passive income.

- This principle is about shifting from an employee mindset (working for a paycheck) to an investor mindset (investing in assets that create cash flow).

- Mindset is Key:

- A significant part of “Rich Dad Poor Dad” is the emphasis on mindset. Kiyosaki explains that the wealthy have a mindset of abundance, thinking about opportunities rather than limitations. They are willing to take risks, embrace failure, and learn from their mistakes.

- The book encourages readers to develop a growth mindset and continuously seek out new opportunities to grow their wealth and financial knowledge.

How “Rich Dad Poor Dad” Can Help You Achieve Financial Success

- Shift Your Thinking About Money:

- Kiyosaki’s book encourages a mindset shift—moving away from the traditional approach of saving and relying on a job for income. Instead, focus on investing in assets that generate passive income. Think about how you can build wealth through entrepreneurship, real estate, or stocks.

- Invest in Your Financial Education:

- One of the first steps toward financial success is improving your financial literacy. Kiyosaki urges readers to learn about personal finance, investing, and money management. There are many resources available today, from books to online courses, that can help you become more financially educated.

- Start Building Assets:

- Whether it’s investing in real estate, starting a business, or purchasing dividend-paying stocks, “Rich Dad Poor Dad” encourages you to acquire assets that generate passive income. By building a portfolio of income-generating assets, you can eventually achieve financial independence.

- Take Calculated Risks:

- The wealthy are not afraid to take risks, but they take calculated risks. Kiyosaki teaches that financial freedom requires stepping out of your comfort zone and taking intelligent risks with your money. This could mean investing in a property, starting a side business, or putting money into stocks that have potential for long-term growth.

- Understand the Power of Leverage:

- Another concept that Kiyosaki highlights is the use of leverage. Leverage allows you to use other people’s money (OPM) to invest in assets. This can be through taking loans or using partnerships to fund investments, ultimately increasing your wealth-building potential.

- Create Multiple Income Streams:

- To achieve financial freedom, Kiyosaki suggests creating multiple income streams. Instead of relying on a single paycheck, you should aim to build several income sources, such as rental income, business profits, or investment dividends. Diversifying your income allows you to weather financial storms and increase your wealth.

Exploring DeepSeek AI: Revolutionizing Artificial Intelligence with Precision and Depth

Why You Should Read Rich Dad Poor Dad

- Challenging Conventional Financial Wisdom:

- “Rich Dad Poor Dad” challenges traditional beliefs about money and offers a fresh perspective on building wealth. The book encourages readers to think outside the box and question the standard “work hard, save money, and retire” mindset.

- Simple and Easy-to-Understand:

- The book is written in a simple, engaging style that makes complex financial concepts accessible to readers of all backgrounds. It doesn’t require prior knowledge of finance or investing to understand the principles Kiyosaki shares.

- Actionable Lessons:

- Kiyosaki doesn’t just provide theoretical ideas—he offers actionable advice on how to improve your financial situation. From understanding assets and liabilities to embracing entrepreneurship, the lessons in “Rich Dad Poor Dad” are practical and can be applied immediately.

- Empowering Mindset:

- One of the key takeaways from “Rich Dad Poor Dad” is the importance of cultivating the right mindset. Kiyosaki’s book is an empowering read that encourages you to take control of your financial future, regardless of your current circumstances.

Conclusion

“Rich Dad Poor Dad” by Robert Kiyosaki is a timeless classic that has inspired millions of people around the world to take control of their financial destinies. By challenging traditional views on money, investing, and wealth-building, Kiyosaki offers a powerful roadmap for achieving financial freedom.

If you’re looking to improve your financial situation, the principles in “Rich Dad Poor Dad” can help you break free from the limitations of a traditional job and set you on the path to financial independence. Whether you’re an aspiring entrepreneur, an investor, or someone looking to get out of the rat race, this book offers invaluable lessons that can transform your financial life.

FAQs

- Is “Rich Dad Poor Dad” suitable for beginners in personal finance?

- Yes! The book is ideal for beginners. It explains financial concepts in simple terms and offers a step-by-step approach to understanding money management and investing.

- Can I apply the lessons from “Rich Dad Poor Dad” even if I don’t have a business?

- Absolutely! The principles taught in the book can be applied to any financial situation. Whether you’re a salaried employee or an entrepreneur, focusing on building assets, financial education, and multiple income streams